Get the free monthly budget template form

Get, Create, Make and Sign

Editing monthly budget template online

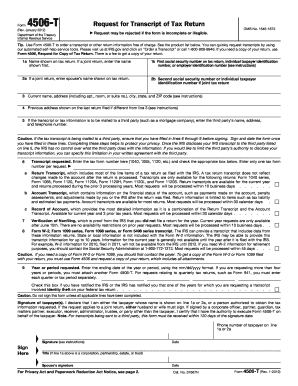

How to fill out monthly budget template form

How to fill out a worksheet monthly:

Who needs a worksheet monthly:

Video instructions and help with filling out and completing monthly budget template

Instructions and Help about freddie mac budget sheet form

Everyone IN#39’m a shooting, and thank you so much for tuning in to my channel today since it is January 16th I believe that means I redid my bi monthly budget you guys saw me kind of struggle through my very first budget earlier in the month and I wanted to share with you the second half of my January budget just because one you all gave me a lot of perfect tips and advice in order to help improve my budget and — I just Guess wanted to show you guys what the last half of my month usually entails honestly this is my second time doing this budget because I'll explain to you guys more in depth, but I definitely just incurred a very, very heavy expense, so unfortunately I did have to read you my budget today, and it took it breaks my heart man it breaks my heart, but you'll see more of that later a couple of things I wanted to share with you let me get my wallet actually looking in my last budget or my first budget I should say I started using the envelope system and basically after you use your budget you take out cash, and you carry around envelopes in order to keep everything organized for me, I found that this system didn't really work too well it was bulky it was kind of allover the place this has just leftover beauty and entertainment money so IN#39’m just going to keep this in the envelopes, but farthings like packs and groceries that Carry around with me just in case I have to pick something up I decided to streamline everything and I kind of just started using bobby pins a lot of you guys sent me links about click clips Could buy and stuff but honestly Didn't really want to spend any more money on it and these bobby pins do the trick, so I have my gas money which has little sticky note on it just because you don't really need a bobby pin forgone $20, and then I have my pet and mygrocerylist, so I just wanted to share that with you guys because I find that it to be much easier than carrying around an envelope system, but we all have our ways to I actually started really getting into my rebates and making sure I got cash back on everything some of the things that I learned a lot of you advised me to go to Costco I did and Have to admit I wasn't super into it Think I wasted a lot of time and money their issues Brian and I IN#39’m sure for a family of four or just a family ingeneralCostco would be really beneficial but for me, it was just the sizes were too big I really hate wasting food and CLUSIF you are really cautious about the ingredients you put into your body Definitely wouldn't recommend Costco Spent two hours going up and down the aisles looking at the ingredients list and while Costco is good deal it's not necessarily the healthiest deal if you have health issues or want to be a little morehealth-conscious maybe I can do a video about really healthy things you can get from Costco and Trader Joe#39’s, so you don't have to waste your time going through labels I thought that might be good idea but let me know if you wouldlike to see a...

Fill monthly family budget forms download : Try Risk Free

People Also Ask about monthly budget template

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your monthly budget template form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.